domenic749529

About domenic749529

Advancements in Online Loans: No Credit Score Examine Choices For Financial Freedom

Lately, the landscape of private financing has evolved dramatically, primarily attributable to the advent of technology and the rising demand for accessible monetary options. Probably the most notable developments in this realm is the emergence of on-line loans that don’t require a credit examine. This progressive method to lending has opened doors for many individuals who might have previously been excluded from conventional financial programs. In this article, we will explore the current state of no credit verify online loans, their advantages, potential drawbacks, and what the future may hold for this kind of financing.

Understanding No Credit score Verify Loans

No credit check loans are monetary merchandise that enable borrowers to entry funds without the lender reviewing their credit score history. This can be notably useful for individuals with poor credit score scores, limited credit histories, or these who’ve faced monetary difficulties prior to now. Traditional lenders, corresponding to banks and credit unions, usually rely closely on credit score scores to assess a borrower’s danger, which can result in many doubtlessly qualified applicants being denied financing.

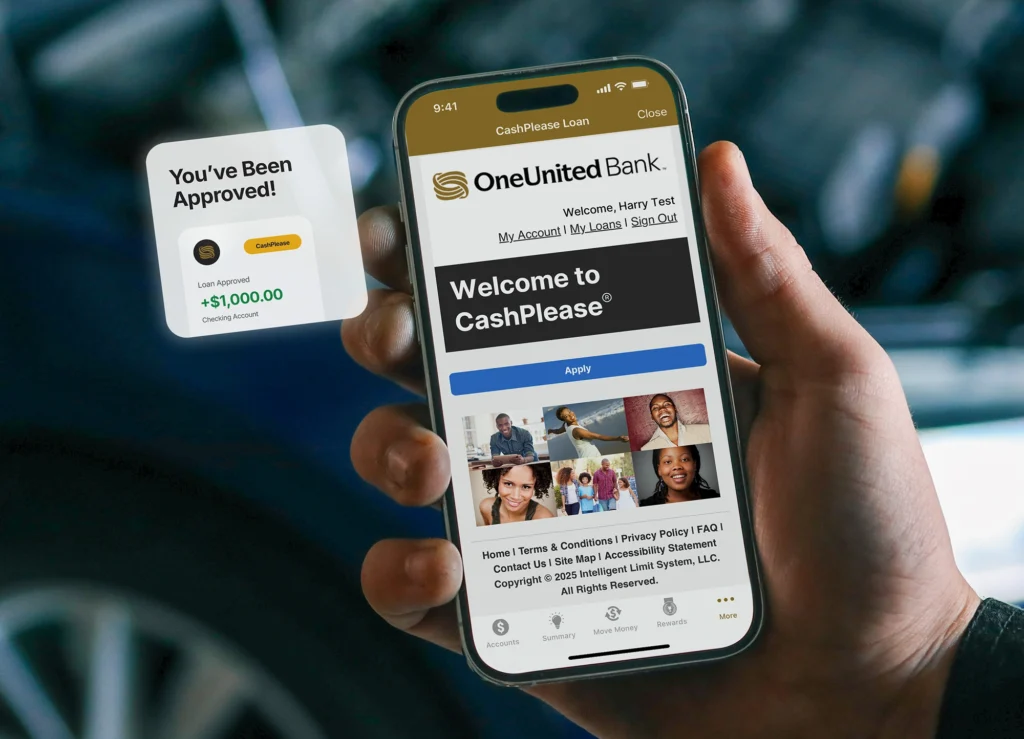

The rise of online lenders has changed this dynamic. Many of those platforms utilize different data and expertise-pushed assessments to guage a borrower’s creditworthiness. This can embody evaluating income, employment stability, and banking historical past, rather than solely focusing on credit scores. In consequence, individuals who may have been neglected by conventional lenders now have access to funds that might help them handle unexpected bills, consolidate debt, or even spend money on alternatives.

The benefits of Online Loans with No Credit Check

- Accessibility: One of many most important advantages of no credit score examine loans is their accessibility. Individuals who’ve been turned away by traditional lenders as a result of poor credit scores can discover relief by online platforms. This inclusivity permits a broader range of borrowers to access obligatory funds.

- Velocity of Approval: Online loans typically offer a streamlined software process. Borrowers can apply from the comfort of their homes, often receiving approval within minutes. This quick turnaround could be crucial for those facing urgent monetary wants, corresponding to medical bills or automotive repairs.

- Flexibility: Many online lenders provide a variety of loan amounts and repayment phrases, allowing borrowers to pick out choices that finest suit their monetary conditions. This flexibility can help people handle their repayments more successfully.

- Much less Nerve-racking Utility Course of: The web application process is mostly less intimidating than traditional mortgage applications. Borrowers can full types at their very own tempo, and plenty of platforms present clear steerage all through the method.

- Various Assessment Methods: As talked about earlier, various information is increasingly getting used to evaluate borrowers. This method can lead to fairer lending practices, as it considers a extra comprehensive view of an individual’s financial state of affairs relatively than relying solely on credit scores.

Potential Drawbacks to consider

Whereas no credit examine loans offer a number of advantages, they are not with out their drawbacks. It is essential for potential borrowers to be aware of these risks earlier than proceeding.

- Increased Curiosity Rates: One of the most significant downsides of no credit check loans is that they typically come with increased curiosity rates compared to conventional loans. Lenders might charge more to offset the elevated danger associated with lending to individuals with poor credit histories.

- Shorter Loan Phrases: Many online loans without credit score checks are structured with shorter repayment intervals. This may result in higher month-to-month funds, which can pressure a borrower’s price range.

- Potential for Debt Cycles: Borrowers who rely on no credit examine loans for ongoing financial wants might discover themselves trapped in a cycle of debt. If people take out multiple loans or fail to repay on time, they can rapidly accumulate vital debt.

- Lack of Regulation: The online lending space is much less regulated than traditional banking establishments. This lack of oversight can lead to predatory lending practices, where borrowers are charged exorbitant fees or subjected to unfair terms.

- Influence on Credit Score: While many no credit score verify loans don’t require a credit score verify upfront, failing to repay the loan on time can still negatively influence a borrower’s credit score rating in the long term.

The future of No Credit score Test Online Loans

As know-how continues to advance, the future of no credit test on-line loans looks promising. Fintech companies are increasingly leveraging artificial intelligence and machine studying to refine their lending practices. These technologies can analyze vast quantities of data to create more correct danger assessments, potentially leading to lower curiosity rates and higher phrases for borrowers.

Furthermore, as shoppers develop into extra aware of their monetary choices, there’s a growing demand for transparency and ethical lending practices. This shift may encourage lenders to undertake fairer insurance policies and improve the general borrower expertise.

Moreover, regulatory our bodies might begin to establish more pointers for on-line lending, guaranteeing that borrowers are protected from predatory practices. This could lead to a extra balanced lending surroundings, the place borrowers can entry needed funds without dealing with excessive fees or unfair phrases.

Conclusion

On-line loans with no credit score test symbolize a significant development within the lending trade, offering essential access to funds for people who could have been previously marginalized by conventional monetary institutions. Whereas there are both benefits and potential drawbacks to contemplate, the evolution of technology and client demand for fair lending practices suggests a shiny future for one of these financing. If you have any issues about wherever and how to use 1000 payday loan no credit check (navigate here), you can get in touch with us at our own website. As borrowers change into more informed and empowered, they can make higher monetary selections that align with their wants and circumstances. In the end, the purpose should be to create a lending panorama that promotes financial inclusion and stability for all individuals, no matter their credit historical past.

No listing found.